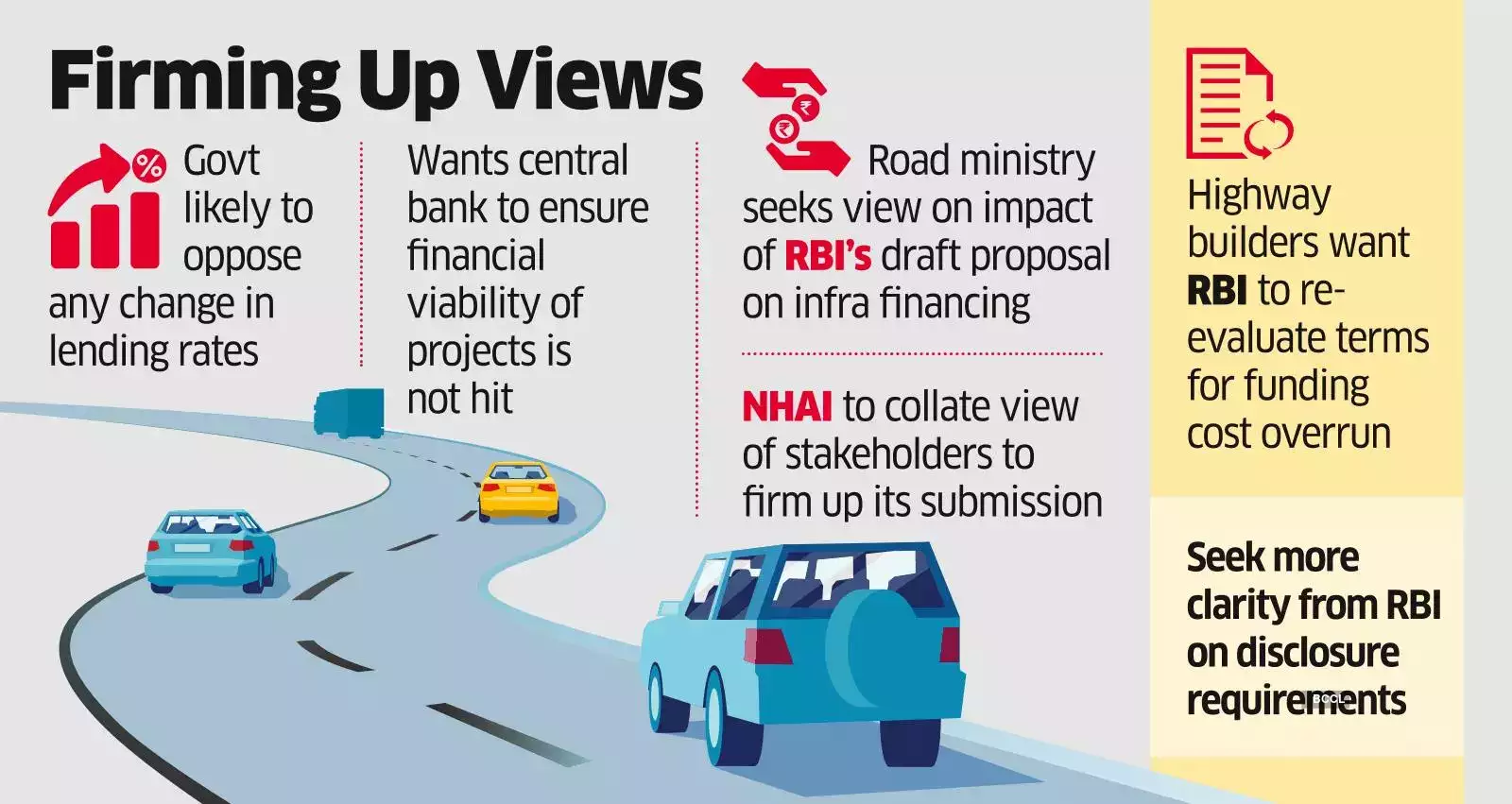

The ministry of road transport and highways will bat for status quo in project finance lending rates even as it seeks views from all stakeholders on the potential impact of draft guidelines proposed by the Reserve Bank of India (RBI), a senior official said.

The ministry will oppose any change in the norms that would lead to a rise in lending rates and urge the central bank to ensure that cost and pace of infrastructure creation is not impacted in the country, the official told ET.

"RBI, as a regulator, will have to create that balance to ensure financial viability of road projects does not take a hit," the official said.

The central bank earlier this month proposed tighter norms, requiring lenders to allocate 5% of the project loan amount as general provisions during the construction phase, up from 0.4% provisions now.

The National Highways Authority of India (NHAI), under the road ministry, has held the first round of meetings with representatives from National Highway Builders Federation (NHBF) and is expected to hold subsequent meetings in the coming days to finalise the ministry's view on the draft proposal.

People aware of the deliberations told ET that the highway builders see a significant rise in financial burden on agencies executing highway infrastructure projects following RBI's proposal of 5% provisions.

"This could potentially hinder the flow of credit to deserving sectors and individuals, ultimately impeding economic progress and the development of vital infrastructure projects," one of the sources told ET.

NHBF is of the view that the stringent timeline for compliance with the provisioning requirements and the provision for funding cost overruns arising from date of commencement of commercial operations (DCCO) extensions could pose challenges for agencies, particularly in infrastructure projects with varying timelines and complexities.

"It has suggested a phased approach to the provisioning requirements so as to provide more time for agencies to adjust to the new provisions and avoid sudden financial strains," the person quoted above said.

NHBF has also urged the central bank to re-evaluate the terms and conditions for funding cost overruns and has sought more clarity in the disclosure requirements to help highway builders streamline the reporting process without excessive administrative burdens.

"Ensuring a fair and sustainable approach for all stakeholders involved in highway infrastructure projects is crucial for the overall development and economic growth of the country," it had said.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.