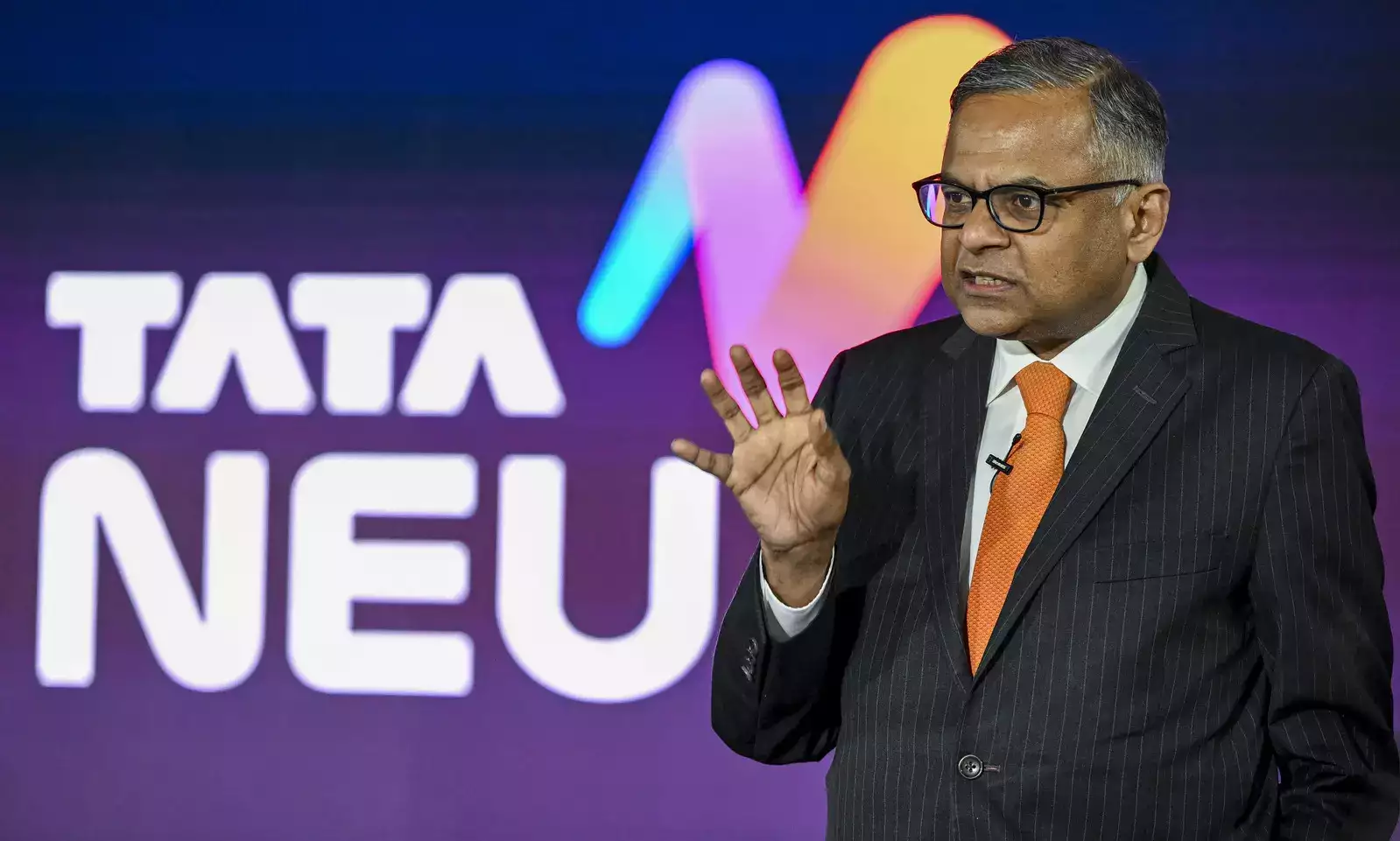

“Our group’s future growth bets are woven along the country’s growth ambitions,” said Chandrasekaran, 61, who took charge in February 2017 and got another five-year term in 2022.

FY24 was a “great year” for the group he said, with aggregate revenue rising 13% while profit surged over 50%. Revenue exceeded USD 165 billion and net profit was more than USD 13.5 billion. Importantly, the group’s net debt remained stable, he said. The biggest investments have gone into Tata Electronics, Tata Digital, Air India and battery manufacturing. Investment committed across businesses, estimated at USD 90 billion currently, will exceed USD 120 billion in the next five years, he said.

Total investments in Tata Electronics will exceed USD 18 billion in the next few years. “Tata Group has done in three years what would otherwise typically take 10 years in the electronics sector—that is the pace at which we are moving,” he said.

Glitches in Tata Neu super app have been resolved, Chandrasekaran said.

“It’s been two and a half years since Tata Digital was launched and while initially, there were some issues with app performance, those have largely been resolved,” he said. “Today, the app is stable and user-friendly. Our financial services have been doing incredibly well. For example, in August, Tata Digital was responsible for 5% of the total credit cards issued in India. Some categories like grocery have underperformed and we are making course corrections… We were a bit late in recognising the rise of quick commerce, but we are now fully engaged in that space.”

Air India, currently undergoing a complex transformation, has faced delays in fleet modernisation due to supply chain disruptions at Airbus and Boeing. “A fully integrated Air India is expected to offer a consistent and improved customer experience by 2026,” he said.

Chandrasekaran also dismissed concerns over electric vehicle (EV) sales, expressing confidence in the long-term outlook. “I firmly believe that EVs represent the future. They are the destination technology for personal vehicles, and at Tata Motors, we are fully committed to this transition.”

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.