|

Domestic Sales |

April- July 2024 |

April-July 2023 |

% change |

| HMSI |

18,53,350 |

12,63,062 |

47 |

| Hero MotoCorp |

18,31,697 |

16,88,454 |

8 |

(Source: SIAM)

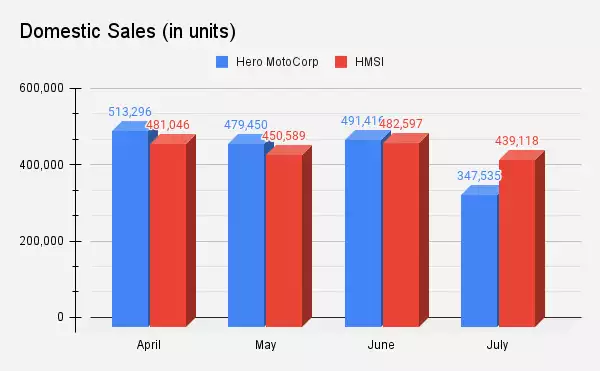

The gap between the two companies has been narrowing over the subsequent months. During April, Hero was ahead in its dispatches by 32,250 units, which came down to 8,819 units by June. HMSI finally overtook the market leader in July by a significant margin of over 91,583 units.

|

Domestic Sales |

Hero MotoCorp |

HMSI |

Difference |

| April |

513,296 |

481,046 |

32,250 |

| May |

479,450 |

450,589 |

28,861 |

| June |

491,416 |

482,597 |

8,819 |

| July |

347,535 |

439,118 |

-91,583 |

Hero MotoCorp has been the market leader in the domestic two-wheeler industry wholesales since the board of Hero Honda - the joint venture with India’s Munjal family, and Japan’s Hero Motor Corp - took the call of parting ways in 2010-11.

Along with having a widespread reach of its retail networks, Hero’s strength lies in the entry-level commuter motorcycles with Splendor and Passion, especially for the rural and semi-urban areas. However, with an increasing trend of premiumisation in the industry, the sales in this segment have been declining across the industry.

HMSI, on the other hand, is synonymous with its Activa scooters, a category which has been its core and is gaining traction over the past few years.

While it is expected that this reversal in sales trend is likely to continue in the upcoming months, industry experts suggest that this could be an outcome of a strong recovery in the scooter segment over motorcycles. One may also note that OEMs are building up inventory and stocking up for the festive season that starts with Raksha Bandhan and Janmashtami in August this year.

Meanwhile, HMSI is yet to take a lead in the retail sales. Thus, the complete picture may be clearer by the end of the third quarter.

To have an edge, both Hero and Honda are strategizing and working on multiple product launches in the premium and emerging electric vehicle (EV) category.

Niranjan Gupta, CFO, Hero MotoCorp, said Hero is seeing a sharp recovery in market share in the 125cc segment with its new Xtreme 125 cc. “Our focus moving forward will be, building our brands in the premium segment on the back of launches done in the past few quarters, to win in this segment. We will be launching new models in scooters as well in the next 2 quarters.”

Two-wheeler growth story

Aided by an improvement in rural demand and in the backdrop of expectation of a healthy monsoon, the two-wheeler industry has been on a revival path over the past months.

“It must be noted however that the volume growth comes on a curtailed base,” said Rohan Kanwar Gupta, Vice President & Sector Head - Corporate Ratings, ICRA.

He added that factors such as rising GDP per capita, urbanization, growing middle class and favorable demographic dividend with a higher portion of the youth population are now driving the premiumization trend in the industry.

On the outlook for the two- wheeler industry, Pushan Sharma, Director- Research at CRISIL, suggests that both entry level and premium two wheeler sales would be aided by the upcoming festive season and new model launches.

“The festival season has been brought forward this year in comparison to FY2024, hence a large part of the wholesale build up is likely to happen in Q2 this year instead of Q3. This is likely to further optically prop up Q2 sales on-year,” he said.

Over the years, there has been a growing demand for scooters over motorcycles. As per CRISIL, the scooter segment’s share has risen from 28% in FY15 to 34% in FY24.

“This trend is attributed to a rising number of women in the workforce and improvements in rural infrastructure. In FY24, scooters had surpassed pre-Covid levels by 4% while motorcycles were still at 94%. The poor performance of motorcycles is on account of subdued rural incomes, with urban areas performing better which is visible in scooter sales performing better than motorcycles,” Sharma said.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.