New Delhi: Tariffs for older petroleum product pipelines will increase 17% next month and rise 3.4% annually from next year to account for inflation and to ensure a reasonable return to operators, the Petroleum and Natural Gas Regulator Board (PNGRB) has said.

PNGRB has issued a new tariff regulation, which will apply from August 1 and replace the one that has existed since December 2010. The new regulation applies to all three sets of product pipelines, including the ones that came before December 2010 and after that and the pipelines that were built following a competitive licensing bid.

“This reform aims to provide the financial stability and attractiveness needed to boost pipeline infrastructure growth in India,” said Anil Kumar Jain, chairperson of PNGRB.

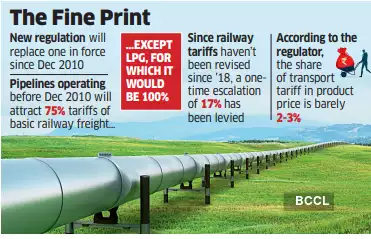

Despite a 17% hike in the railway-derived tariff for these pre-PNGRB pipelines, the tariff will remain much lower than those for the other two sets of pipelines, said Pankaj Bhutani, head of commercial at PNGRB. “The share of transport tariff in product price is barely 2-3% and so would have little impact on product prices. Second, most of the older pipelines are used for captive purposes and the tariff is only notional,” he said.

For pipelines operating before December 2010, the tariff shall be 75% of the basic railway freight for all petroleum products except LPG for which it would be 100%. This benchmarking with the rail freight in the new regulation is the same as in the old. The new regulation provides for an annual escalation of 3.4% per year based on the trailing 10-year compounded annual growth rate of the wholesale price index (WPI). Since the railway tariff hasn’t been revised since 2018, a one-time escalation of 17% has been provided to account for five years’ inflation. The new rate will kick in next month and get revised 3.4% upward in April 2025.

During the consultation for the regulation, Reliance Industries had opposed the idea of an annual pipeline tariff escalation of 3.4%. GAIL and HPCL had asked for an annual escalation of 4.5% and 5%, respectively.

“Indian Railway freight runs on a macro-economic model and does not account for the costs incurred by pipeline entities. There is also no assured rate of return in railway tariff,” said the regulator, justifying the escalation.

For the product pipelines that began operating after December 2010, the tariff shall be determined using the discounted cash flow method with 12% post-tax returns on capital employed over their economic life.

The new regulation will also impact the pipelines whose tariffs for the first ten years of operation were discovered in an auction. Their tariff from the eleventh year of operation will be determined using the discounted cash flow method with 12% returns over the remaining economic life.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.