ET first reported on April 23 that Bansal was in talks to sell his stake in Ather and exit.

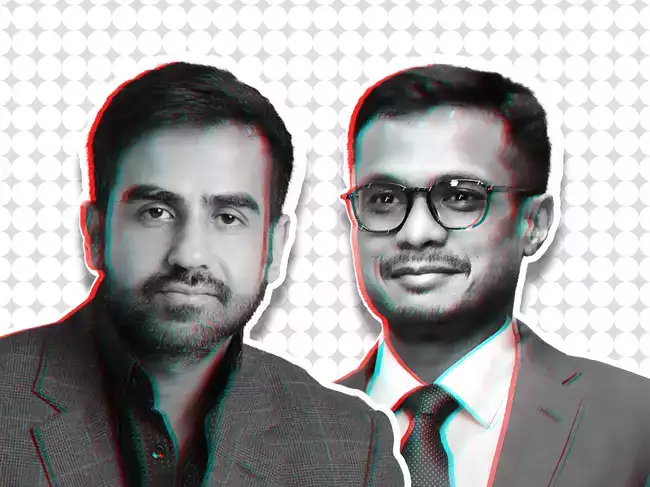

One of the first investors in Ather, Bansal had invested around INR 400 crore over the years starting from 2014.

He had already sold a part of his stake to Kamath, ET reported on April 23. Flipkart cofounder Binny Bansal is also an investor in the company, with a 1% stake.

Hero MotoCorp bought the latest stake at an inferred valuation of INR 5,636 crore, a premium to the valuation of INR 4,666 crore at which the two-wheeler maker had invested INR 140 crore in Ather last December. At the latest inferred valuation, the remaining 5% stake Bansal sold to Kamath would be worth about INR 282 crore.

While Hero MotoCorp made a regulatory filing with the BSE on the additional share purchase, it did not name the investor it bought the additional stake from.

Spokespersons for Hero MotoCorp, Ather and Bansal did not respond to ET’s emails seeking comment. A spokesperson for Kamath declined to comment.

After the latest stake purchase, Hero MotoCorp, which was already the largest shareholder in Ather Energy, holds about 40% of the firm’s total shareholding.

In the investment filing, Hero MotoCorp pegged Ather’s turnover in fiscal 2024 at INR 1,753 crore, which was 1.7% lower than the firm’s operating revenue of INR 1,784 crore in FY23. Hero MotoCorp did not report any profit or loss figure; in FY23, Ather had posted a net loss of INR 864 crore.

The investment comes just a week after the company raised INR 286 crore (USD 34 million) from its founders and Stride Ventures in a mix of debt and equity funding. Ather is finalising plans to raise USD 75-90 million (about INR 750 crore) in primary funding from new and existing investors, with the funding round likely to be led by an existing investor, which might value the firm between USD 850 million and USD 1 billion, ET had reported on April 23.

Ather’s new fundraising comes after it postponed funding plans last year citing poor market conditions. Instead, it raised INR 900 crore in September 2023 from Hero MotoCorp and GIC through a rights issue. Ather competes with the likes of Ola Electric, TVS and Bajaj in the electric scooter segment.

On April 6, Ather launched a new range of ‘Rizta’ scooters, targeting the family segment. The firm, which has a total annual production capacity of 450,000 scooters, said that it would increase the output from 150,000 vehicles a year after the Rizta launch.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.