The final number may still change as the leadership team of the Bengaluru-based electric two-wheeler maker is currently in the process of concluding the scale of layoffs that are expected to be spread across verticals, they said.

A section of the impacted employees may be replaced with new hirings at a relatively cheaper cost, but the overall headcount will shrink, the sources said.

“Inside, they (Ola Electric team) are finalising the list across different teams. Three-four teams have already finalised the numbers but the cuts would be across the organisation,” a person aware of the matter said.

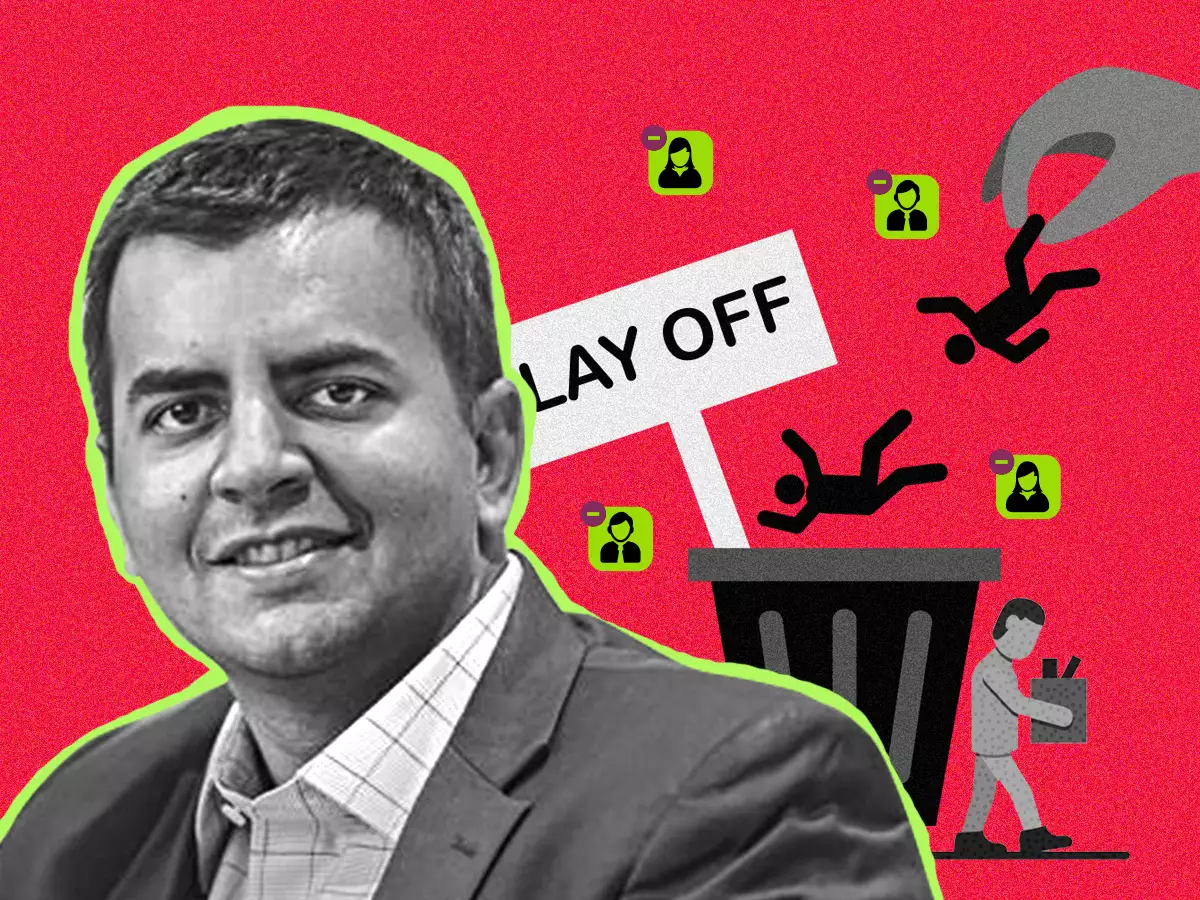

Aggarwal has been consistently pushing to reduce costs across all avenues, the person said.

“We do not know the layoff numbers your sources are speculating,” a spokesperson for Ola Electric said, without any specific comments on the impending job cuts.

At the time of filing its draft IPO papers in December, the S1 Pro electric scooter maker said it had 3,733 employees as of October 2023. Its employee attrition rate was 47.48% in FY23, as per the draft filings.

The IPO application is pending with market regulator Sebi. The company intends to raise INR 5,500 crore via sale of new shares.

In April, Ola Cabs, the ride-hailing business of Ola group, had laid off around 200 employees. Ola Cabs chief executive Hemant Bakshi and chief financial officer Kartik Gupta also had exited the firm in the space of two weeks.

ET reported on May 14 that Aggarwal is steering the ride-hailing business too, working closely with the ‘CXO team’ that includes his brother Ankush Aggarwal who was earlier chief business officer at Ola Electric but has now moved to Ola Cabs.

“The focus across the group is to get to profitability as both units – cabs and electric vehicles – are in various stages of going public,” one of the people cited above said. “That’s the mandate from Bhavish Aggarwal,” the person said.

Ola Electric had posted a net loss of INR 1,472 crore in FY23 on operating revenue of INR 2,631 crore. For the first quarter of FY24, it had reported a net loss of INR 267 crore on operating revenue of INR 1,243 crore.

ANI Technologies – which runs the ride-hailing business – reported a loss of INR 1,082 crore in FY23, just over one-third compared with the year before. Revenue grew 58% to INR 2,135 crore in FY23. In April, Ola Cabs exited from all of its international markets — the UK, Australia and New Zealand.

Focus on market share

The proposed job cuts come as Ola Electric endeavours to maintain its leadership in the country’s electric scooter market, sources said.

In May, the firm sold over 37,000 scooters, cornering 50% market share. Last month, overall non-commercial electric two-wheeler sales grew 17% from a month ago to over 74,000 units.

In April, overall sales fell nearly 50% from the previous month, as a seasonal slump was exacerbated by a shift in subsidies for the industry. Ola Electric sold 33,000 units in April, maintaining leadership but retreating from its all-time high of over 50,000 units sold in March, when discounts and other marketing activities helped boost sales.

The electric scooter market is seeing increased competition, with legacy players like TVS Motors and Bajaj Auto expanding their market shares to 19% and 12%, respectively, in FY24.

Meanwhile, Bengaluru-based Ather Energy is set to launch its family scooter called Rizta, which will be directly competing with the mainstays of Ola Electric, TVS and Bajaj. Ather is also finalising plans to raise USD 75-90 million (about INR 750 crore) in primary funding from new and existing investors as it ramps up production, ET reported on April 23. Last week, regulatory filings showed it has raised INR 286 crore (USD 34 million) from its founders—Tarun Mehta and Swapnil Jain— and Stride Ventures in a mix of debt and equity funding.

After the end of the Faster Adoption and Manufacturing of Electric Vehicles (FAME) 2 subsidies in March, the industry has had to make do with a much smaller INR 500-crore Electric Mobility Promotion Scheme (EMPS). On May 29, ET reported that the FAME 3 subsidy with an outlay of about INR 10,000 crore is likely to be rolled out within the first 100 days of the new government taking charge next month.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.