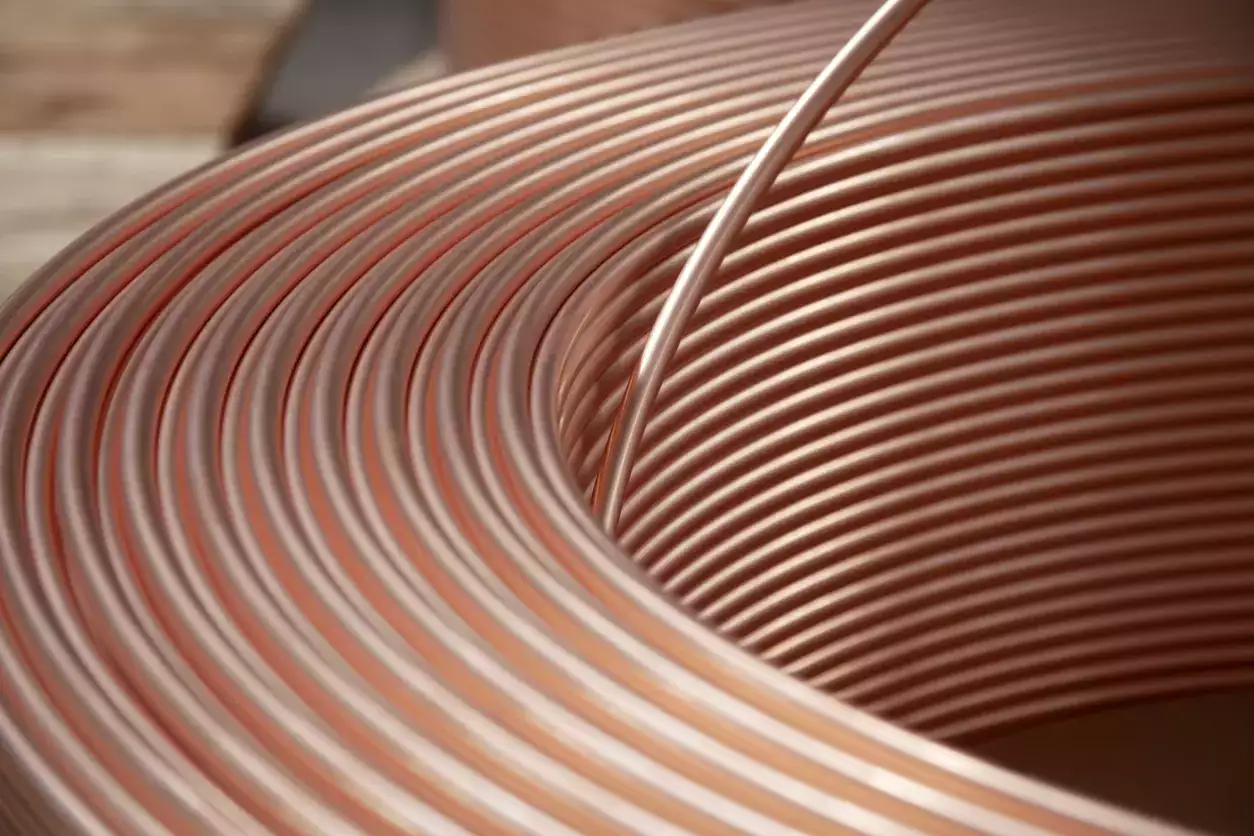

Three-month copper on the London Metal Exchange was down 1.1% to USD 9,050 per metric ton in official open-outcry trading.

The metal, used in power and construction, is heading for a weekly gain of 2.4%, its first in six weeks, as the strike at Escondida spurred concerns about supply disruptions.

Escondida is the world's largest copper mine, accounting for nearly 5% of global supply in 2023. A 44-day strike there in 2017 sparked a copper price rally. This time the strike lasted for just three days.

On the demand side, outlook for the top metals consumer China remained challenging, creating downside risks for copper, said Ewa Manthey, a commodities analyst at ING.

"The prolonged crisis in the property market doesn't show signs of bottoming out yet and we believe this will continue to weigh on copper prices," Manthey said.

"And it's not only subdued demand in China that has been weighing on copper prices; the manufacturing sector looks weak globally, indicating sluggish demand recovery for copper and other industrial metals," she added.

Market attention also was focused on continuing growth in copper stocks in the LME-registered warehouses , which have almost tripled over the last three months.

Daily LME data on Friday showed an increase of 1,600 tons to 309,050 tons, their highest level in almost five years.

Copper inventories in warehouses monitored by the Shanghai Futures Exchange (SHFE) fell 8.4% this week.

Meanwhile, positive U.S. retail sales and jobs data eased worries about a potential recession which had pushed base metals prices down over the past three weeks.

LME aluminium shed 0.9% to USD 2,342 a ton in official activity, tin lost 1.1% to USD 31,625, zinc dipped 1.2% to USD 2,749, lead edged down 1.1% to USD 2,013 and nickel declined 1.0% to USD 16,150.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.